Best insurance rates in NC is a crucial aspect to consider when looking for insurance coverage. Understanding the key factors that impact rates and knowing how to effectively research and compare options can help you secure the most affordable policy tailored to your needs.

Exploring the types of coverage available, the specific requirements mandated by the state, and the various strategies for lowering rates can empower you to make informed decisions that save you money while ensuring adequate protection.

Researching Insurance Rates in North Carolina

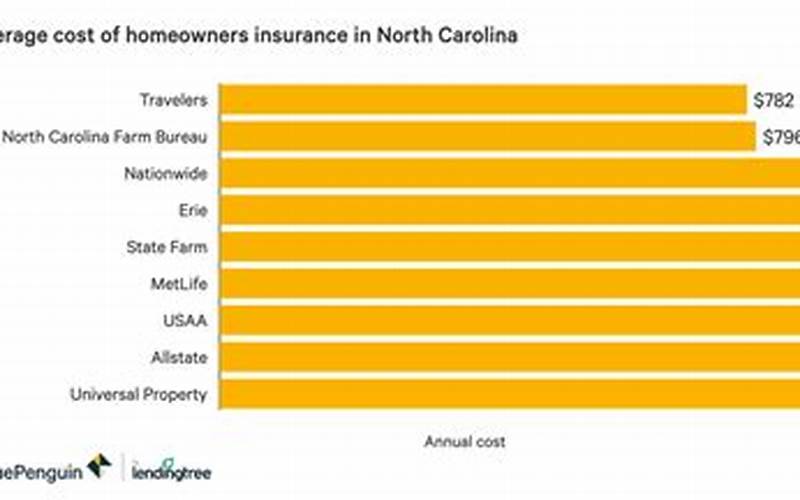

When it comes to finding the best insurance rates in North Carolina, it is crucial to compare quotes from different providers. This allows consumers to identify the most competitive rates and coverage options available in the market. Researching insurance rates from various companies can help individuals save money while obtaining adequate coverage for their needs.

Importance of Comparing Insurance Rates

Comparing insurance rates is essential to ensure that you are getting the best value for your money. Different insurance providers offer varying rates based on factors such as age, driving record, credit score, and coverage options. By comparing rates, you can choose a policy that meets your needs without overspending.

Factors Influencing Insurance Rates

Several factors influence insurance rates in North Carolina, including the driver’s age, location, driving record, credit score, and the type of coverage selected. For example, younger drivers and individuals with poor credit scores may face higher insurance premiums compared to older drivers with a clean record.

Researching the Best Insurance Rates

To research the best insurance rates in North Carolina effectively, consumers can utilize online comparison tools, seek quotes from multiple providers, and consider bundling policies for potential discounts. It is also essential to review and adjust coverage limits to align with your current needs and budget.

Types of Insurance Coverage in North Carolina

In North Carolina, common types of insurance coverage include auto, home, health, and life insurance. Each type of insurance offers different coverage options and benefits tailored to specific needs. Understanding the types of insurance coverage available can help consumers make informed decisions when selecting a policy.

Overview of Insurance Coverage

Auto insurance in North Carolina typically includes liability coverage, uninsured motorist coverage, and optional comprehensive and collision coverage. Home insurance provides protection for your property and belongings against perils such as fire, theft, and natural disasters. Health insurance covers medical expenses, while life insurance offers financial protection for your loved ones in the event of your passing.

State Mandated Insurance Requirements

North Carolina mandates that drivers carry liability insurance with minimum coverage limits to legally operate a vehicle. Homeowners may be required to carry home insurance if they have a mortgage. The state does not mandate health insurance, but having coverage is essential to manage healthcare costs.

Factors Impacting Insurance Rates in North Carolina

Insurance rates in North Carolina can be influenced by various factors, including the insured’s location within the state, driving record, age, credit score, and the type of coverage selected. Understanding how these factors impact insurance rates can help consumers make informed decisions when purchasing insurance policies.

Location and Insurance Rates

The location within North Carolina can affect insurance rates due to varying levels of risk associated with different areas. Urban areas may have higher rates compared to rural areas due to higher traffic density and crime rates.

Driving Record, Age, and Credit Score

A clean driving record, older age, and a good credit score can help lower insurance rates in North Carolina. Insurers consider these factors as indicators of risk and responsibility, offering lower premiums to individuals with favorable profiles.

Type of Coverage and Deductible, Best insurance rates in nc

The type of coverage and deductible selected can impact insurance rates in North Carolina. Opting for higher coverage limits and lower deductibles may result in higher premiums, while choosing lower coverage limits and higher deductibles can lead to lower rates.

Tips for Getting the Best Insurance Rates in North Carolina: Best Insurance Rates In Nc

To secure the best insurance rates in North Carolina, consider bundling policies with the same provider to qualify for discounts. Maintaining a good credit score is also important, as it can help lower insurance premiums. Additionally, reviewing and adjusting coverage limits regularly can ensure that you are getting the best rates for your insurance needs.

Concluding Remarks

In conclusion, navigating the realm of insurance rates in NC can be simplified by arming yourself with the right knowledge and tools. By applying the tips and insights shared, you can confidently secure the best insurance rates that offer optimal coverage at a competitive price.

Question & Answer Hub

What factors influence insurance rates in North Carolina?

The location within North Carolina, driving record, age, credit score, type of coverage, and deductible all play a role in determining insurance rates.

How can consumers effectively research the best insurance rates in NC?

Consumers can compare rates from different providers, consider bundling policies, maintain a good credit score, and review/adjust coverage limits to find the most competitive rates.

What are the common types of insurance coverage available in North Carolina?

Common types of coverage include auto, home, health, and life insurance, each offering varying levels of protection for different aspects of your life.