Lafayette TN insurance plays a vital role in protecting individuals and assets in this region. From understanding the various types of insurance to navigating the insurance claims process, this guide covers it all.

Overview of Lafayette TN Insurance

Insurance in Lafayette TN encompasses various types of coverage that protect individuals, businesses, and assets against financial loss. It is essential to have insurance in Lafayette TN to safeguard against unexpected events and liabilities. Common types of insurance available in Lafayette TN include auto insurance, home insurance, health insurance, life insurance, and business insurance.

Insurance Providers in Lafayette TN

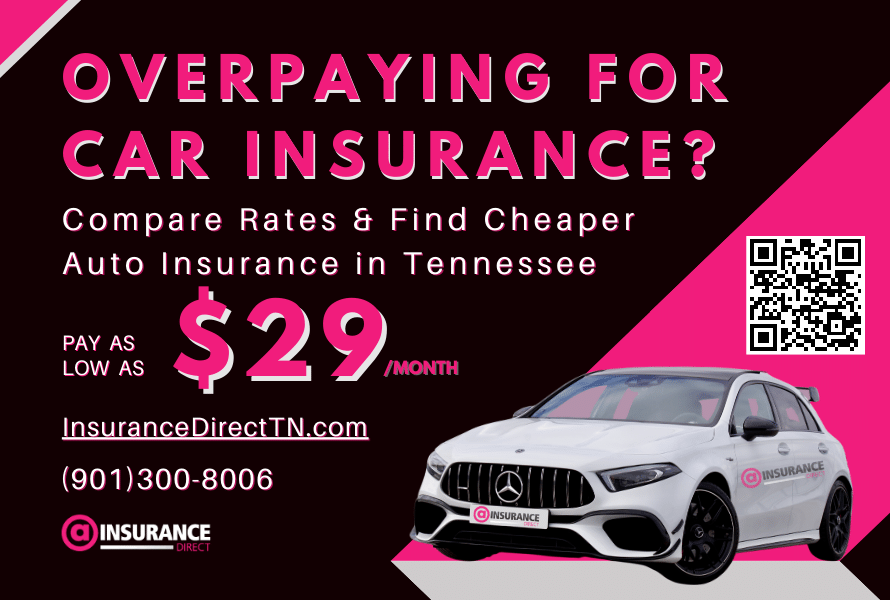

Major insurance providers operating in Lafayette TN include State Farm, Allstate, Farmers Insurance, and Liberty Mutual. These providers offer a range of services such as auto insurance, homeowners insurance, renters insurance, and business insurance. When choosing an insurance provider in Lafayette TN, it is important to compare the services offered, premiums, and customer reviews to find the best fit for your needs.

Factors Influencing Insurance Costs in Lafayette TN

Several key factors affect insurance costs in Lafayette TN, including location, demographics, age, driving record, and credit history. Insurance premiums can vary based on these variables, and individuals can potentially lower their insurance costs by bundling policies, maintaining a good credit score, and taking advantage of discounts offered by insurance providers.

Insurance Regulations in Lafayette TN

Insurance in Lafayette TN is regulated by the Tennessee Department of Commerce and Insurance, which oversees insurance practices and ensures compliance with state laws. Residents of Lafayette TN need to be aware of specific insurance regulations, such as minimum coverage requirements for auto insurance and regulations governing health insurance policies.

Insurance Claims Process in Lafayette TN, Lafayette tn insurance

The insurance claims process in Lafayette TN involves reporting the incident to your insurance provider, providing documentation and evidence to support your claim, and working with an adjuster to assess the damage and determine coverage. Common challenges in processing insurance claims include delays, denials, and disputes over coverage. To expedite the insurance claims process in Lafayette TN, it is important to submit all required documents promptly and follow up with your insurance provider as needed.

Outcome Summary: Lafayette Tn Insurance

In conclusion, Lafayette TN insurance is a crucial aspect of financial planning and risk management. By exploring the nuances of insurance providers, regulations, and cost factors, individuals can make informed decisions to safeguard their future effectively.

General Inquiries

What types of insurance are commonly available in Lafayette TN?

Common types of insurance in Lafayette TN include auto insurance, home insurance, and health insurance.

How can individuals lower their insurance costs in Lafayette TN?

Individuals can potentially lower their insurance costs by bundling policies, maintaining a good credit score, and exploring discounts offered by insurance providers.

What are the key factors that impact insurance costs in Lafayette TN?

Factors such as location, age, driving record, and coverage levels can significantly influence insurance costs in Lafayette TN.